PropNex Picks

|January 27,2026Over 13,000 HDB Flats Will Hit MOP in 2026. What Will Happen Next?

Share this article:

We're entering a pivotal moment in the property scene. After years of constrained resale supply and rapid price growth, a wave of around 13,480 HDB flats will reach their five-year Minimum Occupation Period (MOP) this year, which is nearly double last year's amount (6,970 units).

For many homeowners who bought during the pandemic boom, 2026 isn't just another year. It's decision time. So how will this affect the market? And what does it mean for you? Let's dive straight into it.

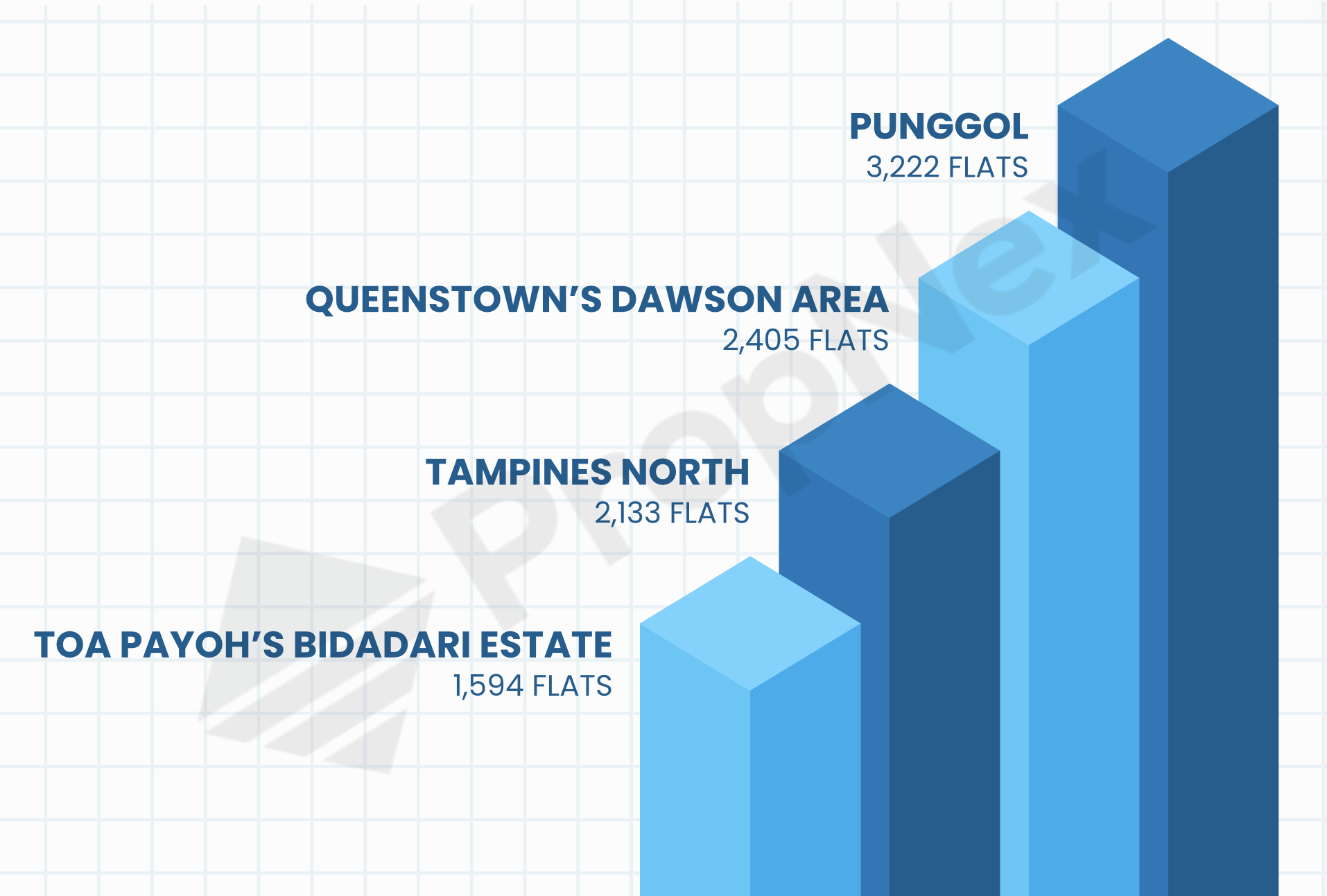

Around 13,480 HDB flats are expected to reach their MOP in 2026. These flats are spread across 22 projects in 14 towns. However, the largest concentrations are in Punggol, Dawson, Tampines North, and Bidadari.

By flat type, most of the MOP supply are 4-room (5,909 units) and 5-room flats (2,711 units). This suggests that family-orientation is a key driver here.

Resale market

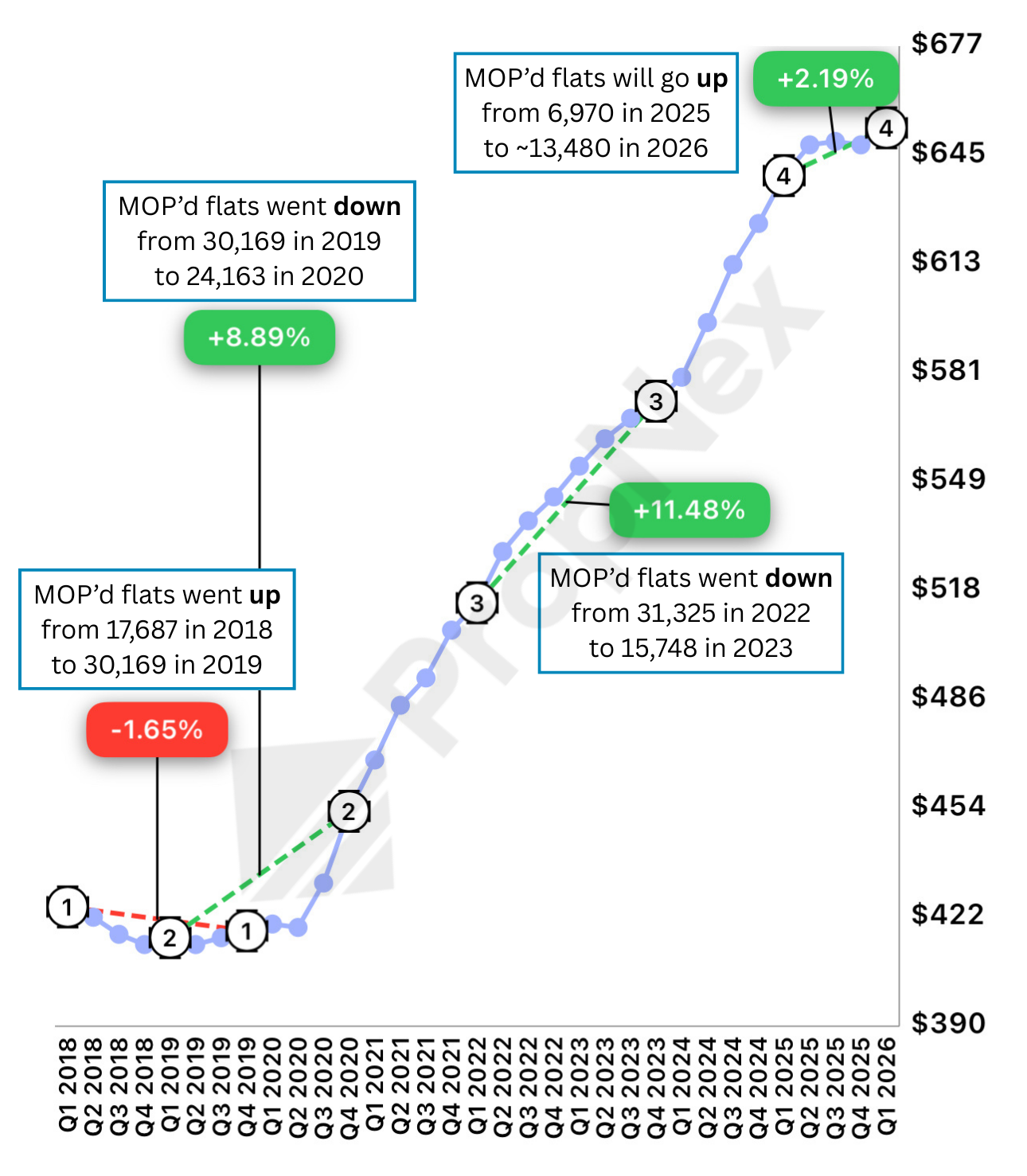

Historically speaking, the number of flats reaching MOP has affected resale price since it has a lot to do with supply. For example, when there was an influx of MOP flats in 2019, resale prices dropped by 1.65%. But when the amount of MOP flats declined in 2020 and 2023, resale prices went up by 8-12%.

And as you can see in the chart below, moderation is already starting to take place. With MOP flats supply nearly doubling in 2026, buyers will have more options, reducing the urgency and competition that previously pushed prices higher. However, it's also not in the red, so it's unlikely that we'll see a sharp correction in the coming year. Rather, we can expect resale prices, which was the slowest it's been since 2019, to continue slowing down.

Source: PropNex Investment Suite

Of course, MOP is just one factor amongst many affecting resale price. Plus, not all locations will be affected the same way since the MOP flats are not spread out equally. The estates mentioned above are more likely to feel the effects. Whereas mature or centrally located areas are likely to remain supported by strong underlying demand.

Rental market

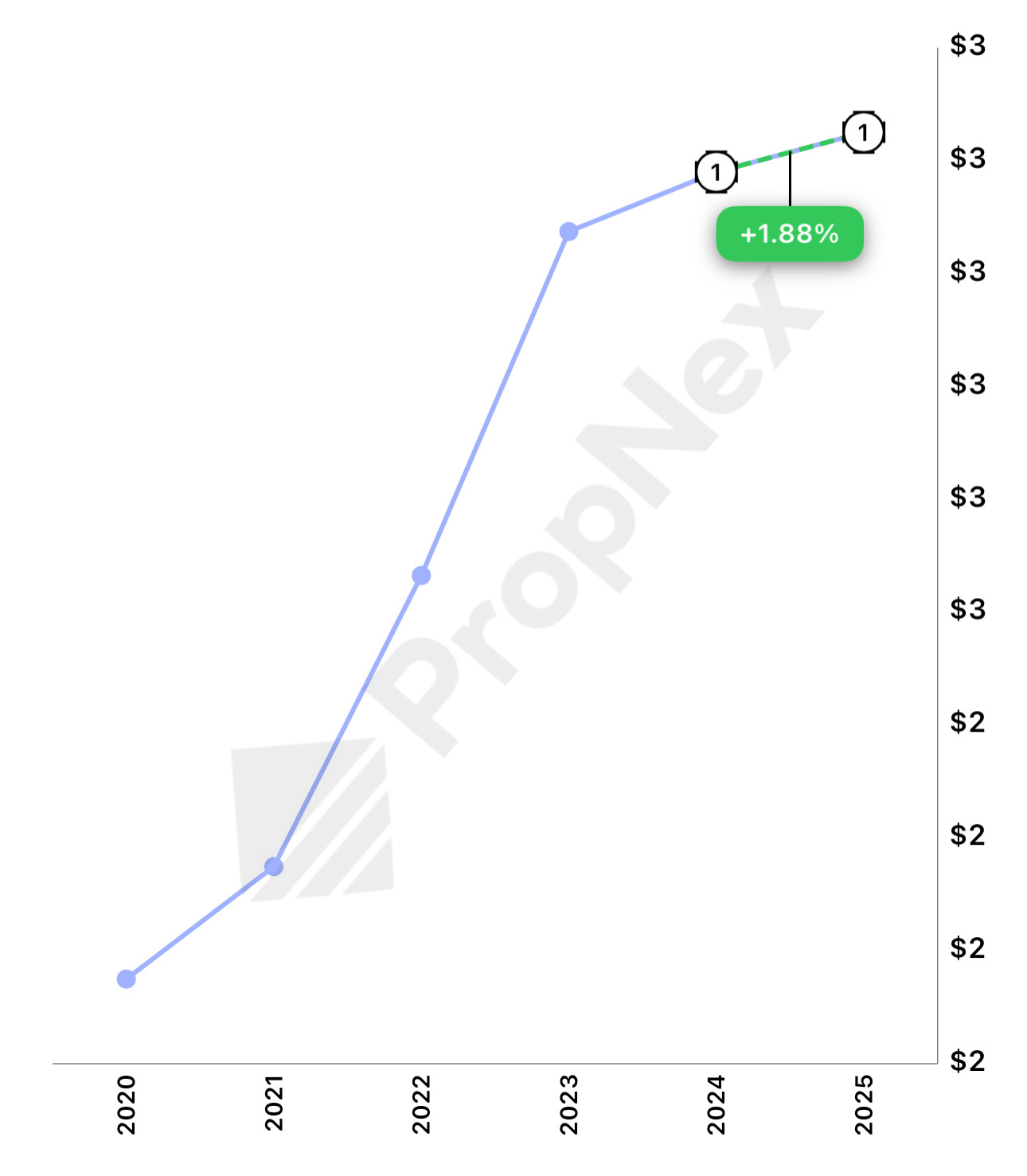

The MOP influx is also likely to further slow the HDB rental market, which has already lost momentum over the past year. As of November 2025, overall HDB rental prices increased by 1.8% compared to November 2024.

Source: PropNex Investment Suite

This muted growth was partly driven by demand for smaller flat types such as 3-room units. Meanwhile, as we've covered, the bulk of flats reaching MOP this year are 4- and 5-room units, which typically compete in a different segment of the rental market. This means that landlords of these larger MOP flats may face increasing competition for tenants.

Beyond supply, rental demand has also normalised as hiring momentum slows in certain sectors, particularly tech. As a result, we are seeing less expats, which means less tenants. This is likely to further moderate rents, especially in areas near business and tech hubs like the CBD.

In any case, analysts have already flagged that rising housing supply is likely to cap rental growth in 2026, and the upcoming MOP wave reinforces that outlook. A likely scenario is a tenant-friendlier market, where landlords face longer leasing periods, greater price sensitivity, and less leverage to push rents higher.

Private sector

With resale choices widening, the effect will inevitably spill over to the private market, albeit indirectly. As more flats become resale-eligible, some owners with matured BTOs may see it as an opportunity to sell and upgrade to an executive condominium (EC) or a condo.

At the same time, a larger resale pool gives buyers more viable HDB options. So it's also possible that some people may choose to upgrade later than planned or trade within the HDB market instead, especially if resale options become more attractive.

In the rental market, the impact might not be significant, but noticeable enough. As HDB rents continue to moderate, tenants who prioritise affordability may opt for public over private options. This could take some pressure off the private rental market, particularly in segments where tenants are more price-sensitive.

That said, any slowdown in the private sector is mainly in the entry-level condo segment. Larger condos, as well as luxury and landed homes, should be relatively unaffected from these dynamics as they cater to a different audience, who are driven more by lifestyle preferences rather than affordability.

For buyers, 2026 could offer more choice and less competition, especially for 4-room and 5-room flats in the aforementioned estates. Negotiating power may improve as supply normalises.

For sellers, you might need to readjust pricing expectations. Location, flat condition, and timing will matter more as competition increases.

For landlords and renters, the balance is shifting. Renters may benefit from a wider range of options, while landlords may need to price more competitively to secure tenants.

The MOP wave marks a recalibration in the property market, at least in certain affected locations. More supply does not mean falling prices across the board, but it does mean that market conditions are becoming more nuanced. This is a market that rewards good judgment over speed, regardless of whether you're a buyer, seller, investor, landlord, or tenant.

In a market like this, outcomes depend less on reacting quickly and more on how each move fits into a broader property strategy, particularly around timing, progression, and risk management. This is why the Property Wealth System (PWS) framework is becoming increasingly relevant. If you're interested to learn more, here's a short clip as a preview. And who knows, maybe we'll see you at the next masterclass!

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.